Welcome to FintechXpndr

Unlock global growth for your fintech

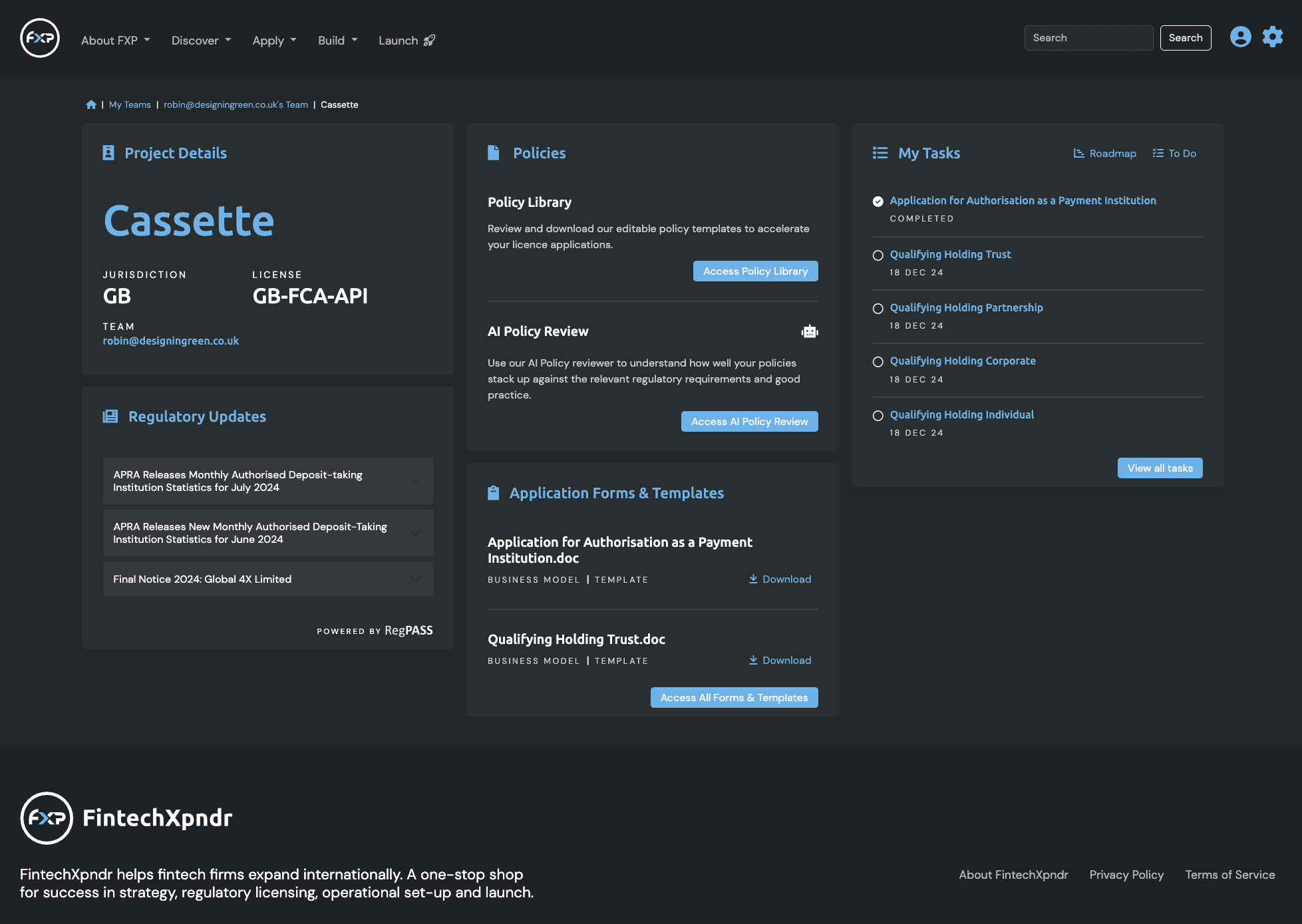

FintechXpndr is the one-stop-shop for international expansion:

- Achieve successful authorization to operate, reaching your expansion targets

- Facilitate licences, registrations and exemptions by the UK's Financial Conduct Authority (FCA) and Prudential Regulatory Authority (PRA) as well as the Monetary Authority of Singapore (MAS)

- Streamline company registration and access banking and accounting services

- Navigate risk, compliance and regulations efficiently, ensuring you can concentrate on your business growth

- Drastically reduce expansion efforts and costs while speeding up your time-to-market